We have a housing problem in the United States and there is a solution that can move the needle for millions of Americans today.

Importantly, this solution should have bi-partisan support as it is hard to see how one political side wins or loses. 2024 is approaching and members of Congress up for re-election should want to tell their voters that they voted to support a new law that permits them to retain a low cost of housing for many years to come. Members of the financial planning community including CFP®s and CFAs should be supportive of this idea, as well as realtors, mortgage lenders, appraisers, and title policy insurers.

The Housing Problem

On the supply side, the housing crash that preceded the 2008 Global Financial Crisis led to a major decline in construction, as capital dried up and homebuilders became increasingly risk averse. The pandemic only added to housing supply woes, as labor shortages, snarled supply chains, and rising commodity prices combined to create fresh headwinds on new construction. All told, various research suggests the U.S. is short somewhere between 1.5 million and 6 million homes.

On the demand side, Millennials (or those aged 26 to 41), are now the largest generation in the country, having surpassed Baby Boomers in 2019. This cohort is not only at prime age for family formation, they also are more likely to have the ability to work remotely – which was one of the major drivers of the housing boom in 2020 and 2021, as workers fled cities in search of homes with more space and home office setups.

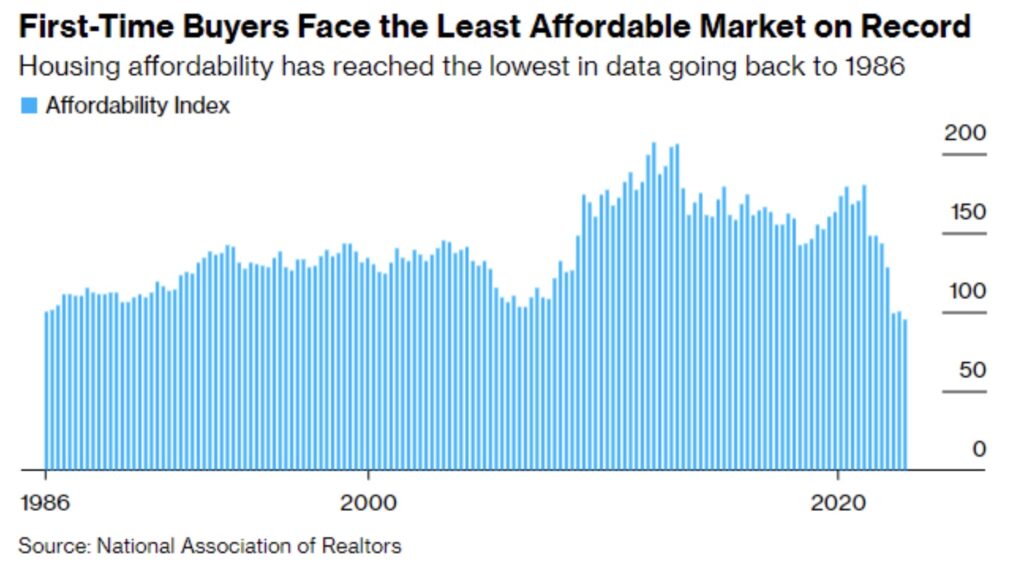

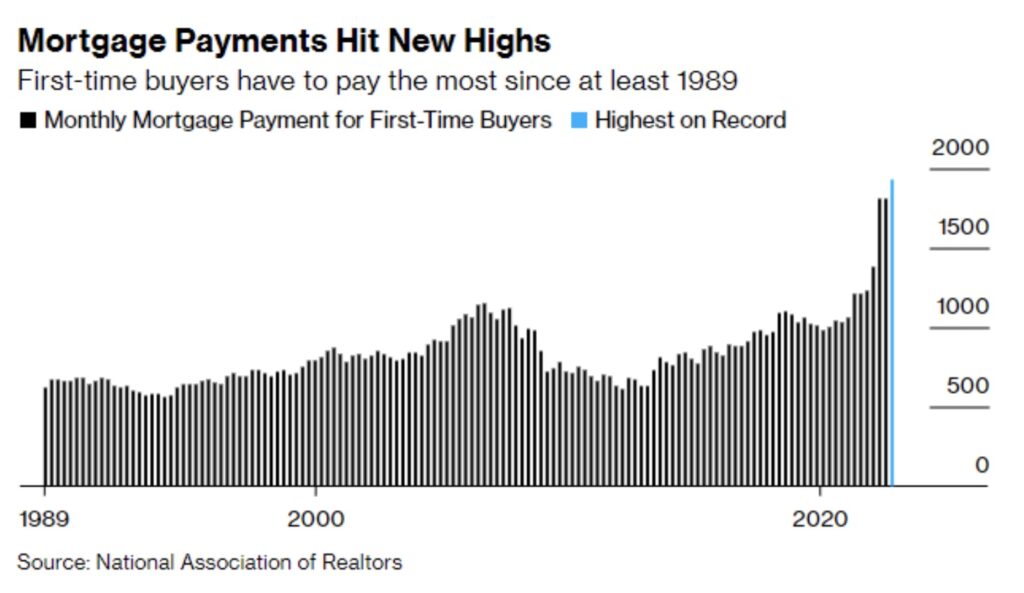

The wide imbalance between housing supply and demand in the U.S. has led to surging prices. This imbalance, combined with the biggest increase in mortgage rates ever in a calendar year (2022), has pushed housing affordability to all-time lows.

Low housing affordability has forced many highly-qualified and even high-earning homebuyers out of the market. According to the U.S. Census Bureau, the number of renter households earning more than $150,000 rose by 87% between 2016 and 2021. More than 3 million American households earning more than $150,000/year are choosing to rent.

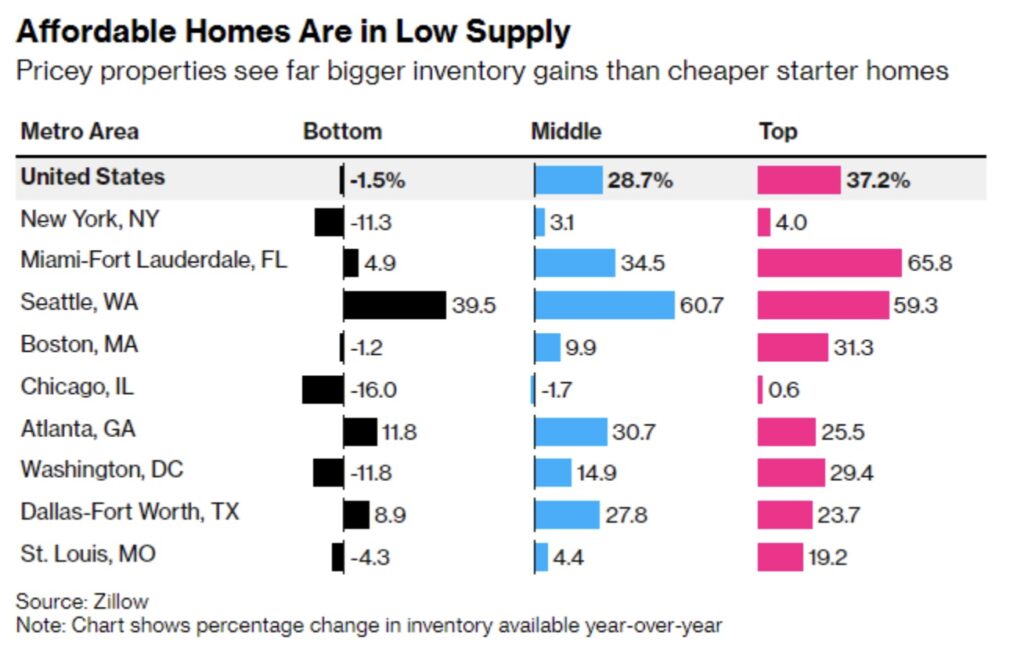

One problem is that the supply of affordable homes is constrained, with inventory gains for cheaper homes lagging the supply of high-priced homes.

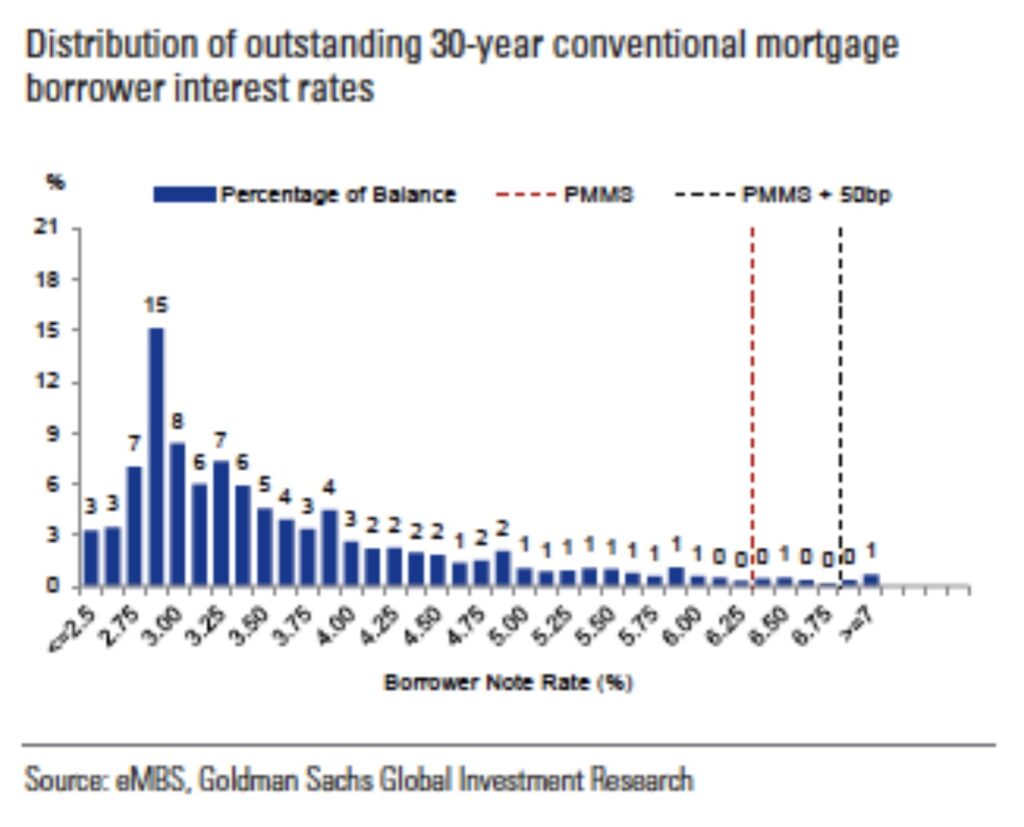

But the more significant issue is that many Americans are highly reluctant to sell their homes for fear of losing their low mortgage rate – – what some in the financial media have termed “golden handcuffs.”

According to Goldman Sachs, 71% of outstanding 30-year fixed mortgages are below 4%. That means for most of the country, there are very few economic incentives to sell. Doing so would mean trading a low mortgage rate for a high one, while also re-entering the housing market after a historic run-up in prices.

Simply increasing the supply of new homes will not fix the issue. We also need to revive the market for existing homes, which would restore mobility to millions of American households in addition to increasing available housing stock. By removing the “golden handcuffs,” we’d be giving people greater ability to move for work, retire where they want to, or live closer to family.

For homeowners who have the option to stay put – which again, with remote work, is increasingly possible – the decision not to move because of interest rates will almost surely keep the inventory of homes below adequate levels, keeping home prices elevated even if demand falls (which does not appear very likely given demographics).

The good news is that we can give homeowners all these benefits with a solution that exists outside of the U.S. but does not get enough attention domestically.

It’s called mortgage portability.

How Mortgage Portability Works

Mortgage portability is a simple concept: Homeowners with low-cost mortgages should be able to port the mortgage to their next home or attach the low rate mortgage to their existing home as an incentive for a potential buyer. The homeowner and mortgage holder would simply swap the new home as collateral in place of the old home, and in the process, preserve the mortgage rate and payoff date. Or, if the owner does not plan to buy a new home, they could sell the home with a low-cost mortgage attached to make the home more attractive to a buyer.

One company stepped up to address this issue in June 2022. E-Trade recognized the value of permitting borrowers to port their low-cost mortgage to another home and took the bold step to launch a mortgage program with a portability feature. E-trade’s portability feature allows homeowners to “port” their current mortgage one time, at a cost to borrowers of an extra 0.375% on their existing mortgage rate. Given that mortgage rates more than doubled from the end of 2021 to the end of 2022 (from ~3% to over 6%), this offer is highly attractive to existing homeowners, and in the very least gives them a great option to support a move. This innovative approach is what’s needed across the lending industry to start to address housing supply and affordability in the U.S.

The commercial real estate market already permits a similar type of transfer in the form of assumable loans on specific properties. This concept is built into many mortgages held by commercial mortgage backed securities (CMBS) as well as loans held directly on the balance sheets of lenders. As would be the case with single family mortgages, the borrower assuming the loan is subject to the underwriting standards of the lender, so the lender retains their protections.

Portable mortgages already exist in Canada, Australia, and England. VA and FHA mortgages are assumable in the U.S. So why aren’t these features more common in the U.S.?

There are several reasons, but the most likely is it’s a new concept, and institutional buyers of large pools of mortgages aren’t used to seeing this feature. Action needs to be taken in a wholesale manner, or it may take quite a few years before rates return to all-time lows and lenders are willing to voluntarily offer this feature when it matters to borrowers.

A broad majority of U.S. homeowners have low-cost mortgages, and many may want to move but see increased financial risks and costs in doing so. Mortgage portability will remove the financial risk of moving for decades to come, and in the process increase the supply of homes for sale—a key step for solving the shortfall in U.S. housing inventory. There is no time like the present and the dramatic surge in mortgage rates over the last 18 months have heightened the urgency for change.

An act of Congress could make all outstanding mortgages portable quickly, which is what the country needs. Congress took similar swift action in 1991 with the passage of the Federal Deposit Insurance Corporation (FDIC) Improvement Act of 1991, which allowed banks to sell their loans to special purpose entities known as securitization trusts, backed by loans. New legislation could unlock significant benefits for homeowners and all constituents supporting each step in the home purchase and financing process.

While it would be a significant change for homeowners, this change would not necessarily change how institutional buyers of mortgage pools behave in the long term. Existing mortgages with rates far below the prevailing market are assumed to remain outstanding for longer time periods. At the other extreme, existing mortgages with rates that are far above prevailing rates are assumed to be refinanced soon, so should remain outstanding for shorter periods of time. Adding portability to the mix would change the inputs to financial models that mortgage buyers and sellers use to value single family mortgages, but not the fundamental reason to own and transact in mortgage securities.

How Mortgage Portability Will Benefit Current and Aspiring Homeowners

The benefits to homeowners with low-cost mortgages are significant.

Homeowners with low-cost mortgages have an imbedded lower cost of housing for the term of their loan. If a homeowner buys a $375,000 home with 20% down, their $300,000 mortgage at a 3% rate has a fixed monthly payment of $1,265. The same loan costs $1,996 at the current 7.0% rate, a $731/month difference that is extremely meaningful to buyers at that price point.

When considering the value of the lower payment over 30 years, the borrower saves almost $150,000 in today’s dollars (assuming a discount rate of 3%). Saving $150,000+ in today’s dollars is simply HUGE. That’s equal to half the balance of their original debt!

Below is a table with savings for mortgages of 3%, 4%, and 5% versus today’s current 7.0% rate.

| Mortgage Rate | Monthly Payment | Present Value Difference (vs 7.0% at 3.0% Discount Rate) |

| 3.0% | $1,265 | $173,385 |

| 4.0% | $1,432 | $133,775 |

| 5.0% | $1,610 | $91,555 |

| 7.0% | $1,996 | $0 |

The homeowner should reap the benefit of their low-cost mortgage regardless of whether they take it with them to their next home, or if they wish to sell their home with the current mortgage attached.

Using the example above, if the homeowner takes a 3.0% mortgage, the imbedded present value savings is more than $170,000 on the overall cost of their next home solely based on the lower cost of borrowing. If the home is sold with the current mortgage attached, the home should be worth $170,000 more to a buyer who would otherwise have to take out a new mortgage with the current 7.0% rate. It’s a win-win.

An important benefit of keeping a current mortgage is the borrower’s ability to retain the current payoff date. If a mortgage is 5 years old, the mortgage will be fully paid in 25 years. If the homeowner can port the same mortgage to a new home 15 years later, the payoff date is in 10 years. By keeping the original mortgage, borrowers should be able to pay off their home loan before they retire versus having to start all over again with a new 30-year payoff date when they buy a new home.

Mortgage portability should also help address the current labor shortage in the U.S. If housing stock rises across the U.S. and homeowners can port their mortgages, the ability to take a job in another city or a different state is firmly on the table.

Politically, a new federal regulation or law that makes mortgage portability a mandatory feature for all currently outstanding and future home loans should be very popular with homeowners. Goldman Sachs research (see chart on page 3) estimates that 71% of homeowners have a 30-year fixed mortgage with a rate below 4%, and data from the Federal Reserve Bank of St. Louis shows the US homeownership rate at approximately 66% (as of the end of 2022). The napkin math here suggests that approximately 47% of all U.S. households would benefit from mortgage portability. That’s a lot of voters who would be grateful for this legislative change.

With just over $13 trillion of outstanding one-to-four family residential mortgages (per the St. Louis Federal Reserve Bank), $9 trillion of outstanding mortgages have rates below 4%. When you consider that mortgage portability could save borrowers with 3-4% rates approximately one-half to one-third the value of their mortgages, napkin math suggests that portability could save those borrowers $4 trillion in today’s dollars!

The $4 trillion of savings does not include the economic benefits derived by other constituents whose small businesses are integral part to the home sales and lending markets. With mortgages portable, homeowners are free to look for another home as they can take the low cost of borrowing with them as often as they like. Given the higher expected volume of home sales, the demand for services from these constituents should increase significantly, which should serve as a tailwind for broad support.

As home sales increase, the following constituents would benefit:

- Realtors: Mortgage portability would release homeowners from the ‘handcuff’ of their current low mortgage rate, driving buying and selling activity across the housing market. The cost of a mortgage might increase if a “blended” loan is part of the new legislation. A blended loan would require underwriting by a mortgage company and would be at a blended rate (the weighted average of the current loan balance and rate blended with the additional loan balance at the new rate).

- Mortgage Companies: They would be involved in re-underwriting the new home to ensure it qualifies as collateral. They would not have to re-underwrite the borrower as the borrower already qualified for the existing mortgage unless the borrower is applying for a larger loan amount using a “blended” rate. If a new person is taking over the loan from the current borrower, the mortgage company would underwrite the new borrower to be sure they qualify. The home, in this case, is already serving as collateral for the current loan, so no underwriting on the home is necessary. The mortgage company would earn an origination fee for their underwriting services, but they should not charge a higher fee for a portable loan underwriting than they would for a new loan.

- Appraisers: Would be involved in appraising the new home being purchased that will serve as collateral for the current loan. No appraisal is required if a buyer is assuming the portable loan on a property that is already serving as collateral for that loan.

- Title Policy Insurers: Title policies insurers would issue an updated title report for the home being sold and for the home being purchased. At the very least, they’ll update the title policy if a current loan is being assumed by the buyer of the home serving as collateral for the loan being ported to them by the current homeowner (who is selling their home with their low-cost loan attached).

- State and Local Tax Authorities: Some states and local municipalities, such as New York, already charge mortgage recording taxes on new mortgages and refinancing. Since the transferability of a mortgage is a significant economic win for a homeowner, imposing small transfer taxes on “ported” mortgages could benefit state and local governments without materially diminishing the benefits to homeowners.

- Current Owners of Mortgage-Backed Securities: The interest earned on funds held in escrow from the sale of a current home may be paid to the owner of the current mortgage. Alternatively, the interest on fund held in escrow could be used to help supplement the borrower’s mortgage payments until they find a new home. The principal balance of the funds held in escrow is applied to the closing on the buyer’s next home. This deferred escrow structure gives a homeowner time between the sale of their current home and the purchase of their next home. A six-month period should be sufficient to facilitate the purchase of a new home.

So, who is going to complain about mortgage portability? This change would affect how institutional holders of mortgage securities value their portfolios and manage risk in those portfolios. The owners of mortgage securities are sophisticated financial institutions who know how to hedge their exposure to market factors using extremely liquid securities and derivatives markets. Changes in regulations, capital ratios, tax treatment, etc. are not new in the capital markets, and each change requires participants to revisit old valuation and risk models and update them with new assumptions. New portability regulations would be no different and, frankly, it would necessitate a bit of portfolio rebalancing and transactions that many market participants may welcome given the increased trading volume.

In Conclusion

A home is commonly the most significant asset a family owns. And a mortgage is generally a family’s most significant debt. Mortgage portability can provide a family with certainty over the cost of housing, permitting them to benefit from the very good decision to buy a home or refinance when rates were near all-time lows. This seems like a good objective for a new law or new regulations.

Given the benefits to so many homeowners and the ancillary benefits to other constituents in the home sales industry, this is an issue that can move the needle for millions of Americans today.

A quick summary of the pros and cons of mortgage portability is included as an exhibit.

Exhibit – Pros and Cons of a Portable Mortgage

Pros of Having a Portable Mortgage

- Transfer a mortgage between properties when selling a home

- Mortgage can be transferred to another person (in Canada, the buyer of a home, a spouse, an adult child, or a friend may all qualify to take advantage of a homeowner’s mortgage interest rate and terms)

- Interest rate and terms remain the same

- No need to requalify, since the borrower already has the mortgage

- No prepayment penalties because the original mortgage is not prepaid

- No need to restart the amortization period

- May reduce mortgage closing costs

- May not need to make a down payment on a next home if the loan to value ratio on the ported loan is better than when the mortgage was originally issued

- Interest earned on funds held in escrow can benefit either the borrower or the owner of the mortgage

Cons of a Portable Mortgage

- Is only available when you sell, then buy a new home within a short period of time (6 months or so)

- The current rate only applies to the remaining balance on the mortgage

- A blended rate (if a larger mortgage is necessary) may be higher than the initial mortgage rate

- Variable rate mortgages would have no benefit

- Transfer fees may apply

- Updated title policy fees may apply

- A new borrower will be subject to underwriting by the lender, and the new borrower’s credit score, gross debt service, and total debt service ratio requirements must be met.

- Current owners of securitized mortgages would need to adjust their assumptions regarding the average expected life of mortgages they own

This material is for information purposes only and for the use of the recipient. Under no circumstances is it to be considered an offer to sell, or a solicitation to buy any investment referred to in this document. Although we believe our sources to be reliable and accurate, we assume no responsibility for the accuracy of such third‐party data and the impact, financial or otherwise, it may have upon any client’s conclusions. Delegate Advisors, LLC has not audited or otherwise verified this information and accepts no liability for loss arising from the use of this material. The information contained in this document is current as of the date indicated. Delegate Advisors, LLC undertakes no obligation to update such information as of a more recent date. Any opinions expressed are our current opinions only. Nothing herein should be construed as investment, legal, tax or ERISA advice. You should consult with your independent lawyer, accountant or other advisors as to investment, legal, tax, ERISA and related matters to which it may be subject under the laws of the country of residence or domicile concerning the acquisition, holding or disposition of any investment in the account. Past performance is not indicative of future results. All investments involve risk including the loss of principal. Any investments discussed within this material may be subject to various fees and expenses, which will have a negative impact on performance.